Do You Have Any Dependent Children?

How many children under 18 ?

How many children over 18 ?

Are You Married?

Does your spouse need aid and attendance?

Do You Have Any Dependent Parents?

How many?

Customer support is available!

Disclaimer: Our VA disability calculator is only an estimated calculation. It relies solely on input from the user.

Find out how to calculate your VA disability compensation with our VA disability calculator by watching with this helpful explainer video below:

Even in peacetime, military service is a hazardous occupation.

Service members can work in environments that often expose them to extreme noise, hazardous substances, and the risk of injury from many possible sources.

These can lead to persistent illnesses, hearing, vision, and cognitive impairments, ambulatory difficulties, and chronic physical and mental problems including traumatic brain injuries, depression, substance abuse, post-traumatic stress disorders, and in some cases even suicide.

Alone or in combination, these consequences of service can hinder or prevent qualifying for post-service employment and lead to reduced quality of life for affected veterans and their families.

The need for veterans to understand how to qualify for and get the most from service-connected VA disability pay has never been greater than it is today. Having a service-connected disability is increasingly prevalent among American military veterans, and the severity of those disabilities is getting worse:

According to the Veterans Administration, the most frequently reported service-connected disabilities among new claimants are, in descending order:

The VA provides disability benefits to US military veterans who have experienced a disabling event while on active duty. According to 2020 US Census data, in 2018 more than 3 million US service veterans were receiving monthly service-connected disability compensation.

Generally, to qualify for VA disability benefits you must show a current physical or mental health disability that has a service connection.

Proving a service connection includes filing a claim for VA disability benefits and in most cases undergoing a Compensation and Pension examination. If the VA concludes that you have a service-connected disability, then it will assign a disability rating to you from 0 to 100 percent, in 10-percent increments.

In some circumstances, instead of requiring you to show a service connection to the disability, the VA will presume that a service connection exists. Examples of presumed service-connected circumstances include exposure to Agent Orange, asbestos exposure, Gulf War Illness, exposure to ionizing radiation from above-ground nuclear weapons testing, exposure to industrial solvents in the water supply at Camp Lejeune, North Carolina, exposure to burn pits in Iraq or Afghanistan, and being a prisoner of war.

You, your spouse, and dependent parents and children whose disability claims the VA accepts might qualify for the following kinds of benefits:

If you are a disabled veteran or believe you have a service-connected disability, then how much you can receive in disability benefits depends on your combined VA disability rating. You can use the VA combined rating calculator to determine your monthly disability compensation.

The VA can calculate your disability rating in a number of ways.

One way is your original claim for a service-connected disability. If your disability worsens over time, you can file a claim for an increased disability rating for the original claim.

Or, if you already have a disability rating but are experiencing one or more secondary service-connected disabilities, you can file a secondary claim.

An original disability claim is usually one that has a direct service connection. This means that the disability arose while you were in military service.

When you file an original VA disability claim, in addition to documentary evidence you provide to support your service-connected disability claim, the VA may ask you to undergo one or more medical claim examinations.

Not every original benefits claim requires a claim examination.

For example, if you have one or more of some identified chronic, tropical, or prisoner-of-war related illnesses or diseases, have cancer related to service-connected radiation exposure or to water contamination at Camp Lejeune, or have disabilities connected with herbicide agent exposure, then by law as long as you meet certain other eligibility requirements the VA will presume that your disability is service-connected.

These requirements can include, depending on the disability, serving for 90 days during a war or after December 31, 1946, serving at Camp Lejeune between 1953 and 1987, or being able to show that a chronic, tropical, or prisoner-of-war related disease or illness manifests itself to at least a 10 percent disability level within a set period of time.

If the VA requests you to have a medical exam, the reason why is to help the VA to decide whether your benefits claim is service-connected and to assess the severity of the disability.

Also, if you have an existing service-connected disability rating, then a claim exam can determine whether your current disability rating needs to be increased because of a worsening condition.

The results of your claim examinations go to a VA claims processor, who takes them into account when determining what your disability rating is. If you have a compensable disability, then this rating is measured in 10 percent increments, from 10 to 100.

Your disability rating is the base number to use with the VA disability rating calculator. The calculator’s results can vary considerably depending on additional factors that might apply to your disability claim.

These factors include how many compensable disabilities you have, whether you have a spouse and any dependent children, and whether either or both of your parents are living with you as dependents.

If you have multiple disabilities, then instead of considering each disability rating separately or simply adding them together in a sum, the disability calculator uses a formula to calculate a combined rating for them all.

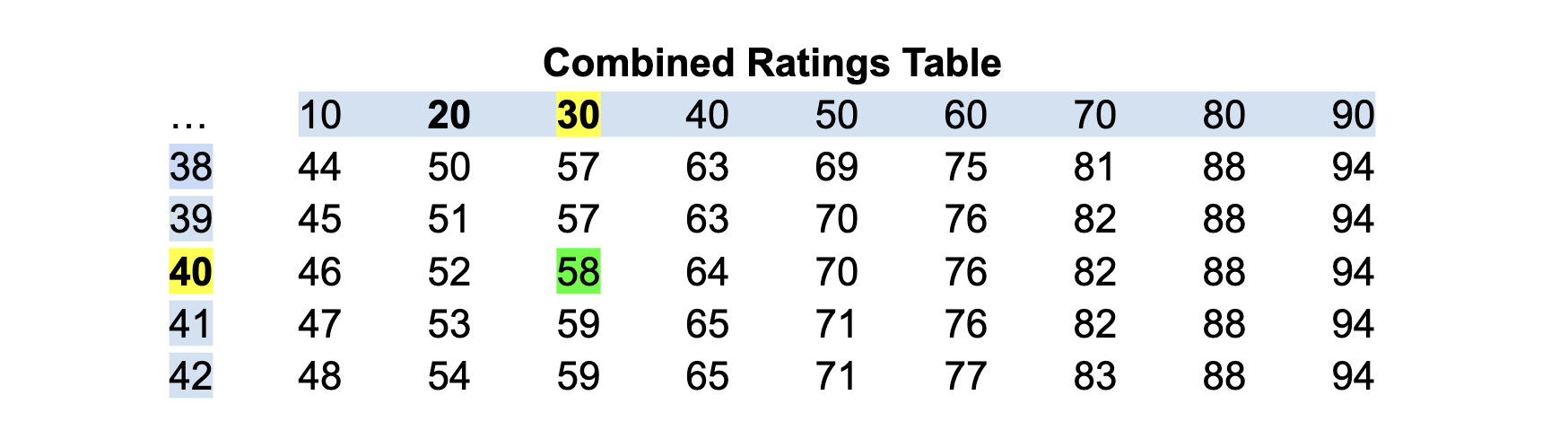

The formula works as follows:

In this example, when you trace the intersection between the 40 percent and 30 percent disability figures in the table, the number you see is 58.

If your third disability rating is your last one, then your combined disability rating for all three disabilities would be a combined VA disability rating of 70 percent (rounding up the 66 percent figure to the nearest 10 percent).

If you have four or more disabilities, then you repeat the process in step 4, taking the 66 percent figure to use in the left-hand column of the table and then tracing to the right from it until you are under the fourth disability rating in the top row.

Repeat this process until you have calculated your last, least severe disability into the table.

When you round the final figure, that will be your combined disability rating.

You file an application for an increased disability rating in the same way you would file an original VA disability claim.

You will need to send with your benefits claim supporting evidence from a medical professional, layperson, or both to support your claim that your existing disability has become worse.

A supplemental claim is connected with your original claim, except in this case the VA denied your original benefits claim and you are reviving it with new evidence.

A service-connected disability is “secondary” if it is one that is linked to an existing service-connected disability.

Sometimes, one disability will eventually cause another disability to arise.

Examples the VA uses are arthritis as a secondary disability from an existing service-connected knee disability, or if you develop heart disease as a result of high blood pressure that you were diagnosed with as a service-connected disability.

Another way to qualify a second disability for benefits is to show that you had a pre-existing disability that your service-connected disability made worse.

This is not the same as a secondary service-connected disability: the difference between the two is that a service-connected disability causes the secondary service-connected disability, while a service connected disability does not cause a pre-existing disability but rather aggravates it.

Service-connected disabilities that affect both arms, both legs, or skeletal muscles that work in pairs can be especially limiting because they make it difficult or impossible for you to compensate for injury to one limb by using the other. The VA recognizes this problem and provides an additional benefit for it: the Bilateral Factor Disability Rating.

Qualifying for the Bilateral Factor requires staying within the following criteria:

Example: Now that we have the basics of the Bilateral Factor down, let’s consider an example of how it works—and the difference it can make in your comprehensive disability rating. We will assume that you have an injury to your left elbow that is a 50 percent disability rating, and an injury to your right wrist that is a 20 percent disability rating.

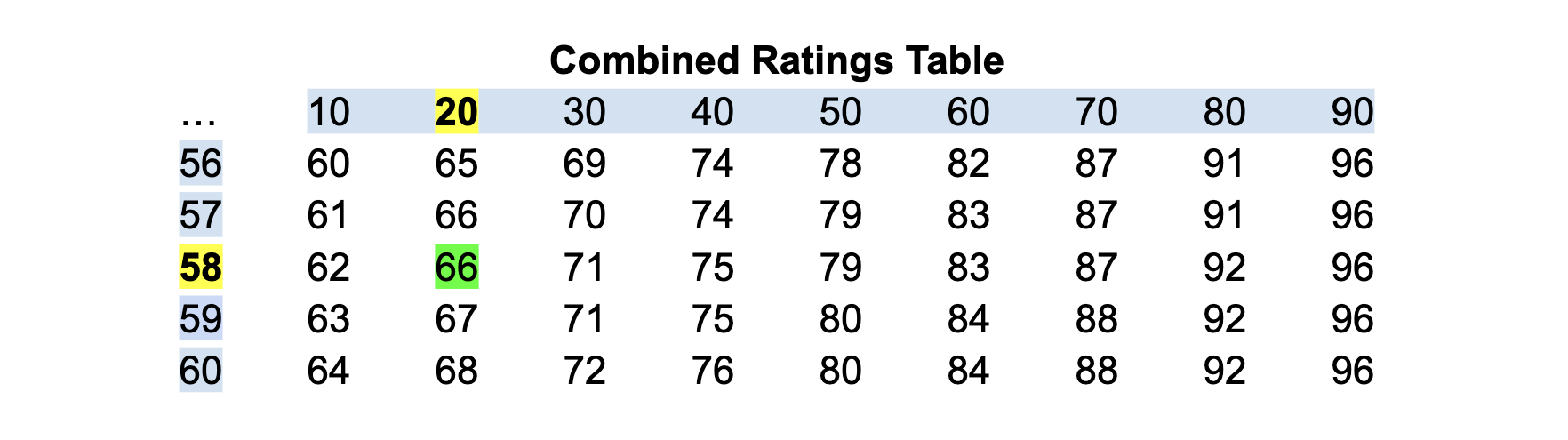

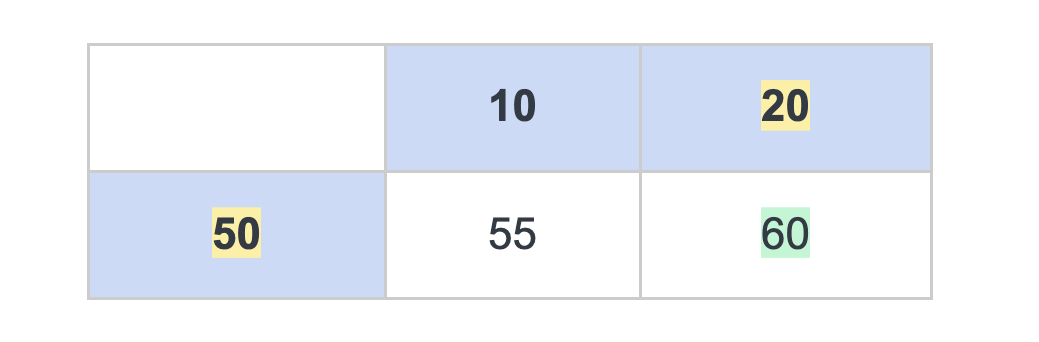

First, we go back to our VA combined rating calculator. We begin by using just the two limb disability ratings, even if you have additional disabilities to add later:

We start with the higher 50 percent disability for the left elbow, then trace right to the column underneath the 20 percent disability for the right wrist. This leads to a combined disability rating of 60 percent.

Next, we apply the Bilateral Factor.

This equals 10 percent of the combined rating.

In our example, 10 percent of 60 percent is 6 percent. This 6 percent figure is the Bilateral Factor amount, and we add it to the 60 percent to reach a new combined rating of 66 percent. Then, as always, we round that figure to the nearest 10 percent, which boosts the combined disability rating from 66 percent to 70 percent.

This is the power of the Bilateral Factor. This new 70 percent combined rating is what you will then use if you have to add more disabilities to your combined rating, just like we calculated in our examples above.

In this example, there is another major benefit that comes from the Bilateral Factor boost.

As we will see later on below, if you cannot hold a job because of a service-connected disability, and have a 70 percent combined disability rating, calculated with at least one disability rating of 40 percent or more, then the Bilateral Factor can qualify you for the Individual Unemployability Compensation Benefit—which increases your effective combined disability rating to 100 percent.

Thus, courtesy of the Bilateral Factor, in this example we see an increase of 40 percent in your disability rating, from 60 percent to total disability. Although you may not receive such a dramatic boost if you benefit from the Bilateral Factor, it can nonetheless make a positive difference in the amount of service-connected disability compensation you are eligible for.

Once you have your combined disability rating, you can use it to begin your monthly VA disability compensation payment amount calculation with the 2024 VA disability pay chart.

How much VA disability pay you are entitled to receive depends on a multi-layered analysis of how your disability rating and your living situation come together to reach a final result.

We will walk through this procedure next.

The lowest level for service-related disability compensation is for veterans with combined disability ratings of 20 percent or less. This is also the simplest calculation because at this level the VA does not consider whether you have any dependents.

| Disability rating | Monthly payment |

|---|---|

| 10% | $171.23 |

| 20% | $338.49 |

Beginning with disability ratings at 30 percent, the VA begins to consider your dependents in the benefit amount calculation. This is also known as the “30 percent rule.”

Benefits for your dependents are not automatic. You must apply for them, and the people you apply for must qualify.

The best time to apply for dependent disability benefits is at the same time you file your own application for disability benefits.

This may not always be possible: for example, your initial disability rating may be less than the minimum 30 percent level needed to claim dependent benefits, but because of a worsening condition, it may exceed that level at a later time, or you might add a child to your family after your initial application.

You can do this online or with a paper-based application using the same form as you would for an initial dependent disability benefit application.

Let’s begin then, by seeing who can qualify as a dependent.

Despite the existence of a legacy regulation that defines a spouse as a person of the opposite sex, the VA does recognize same-sex marriages for dependent spouse purposes. Unlike with parental disability benefit claims below, there are no income or asset restrictions placed on spousal disability benefits eligibility.

You can apply online for dependent spousal benefits, unless your marriage is a common-law marriage, in which case you must deliver a hard copy of your application to your local regional VA office in person or by mail.

For VA disability compensation purposes, your child must meet the following criteria to be eligible for dependent benefits:

Like with spousal disability benefits, you can apply online for your dependent children.

You use the same application form that you would for a spousal benefit application, Form 21-688c, unless the application is for a child who is between 18 and 23 years old and is attending a VA-approved course of instruction. In this case you will file VA Form 21-674.

To receive additional benefits for a dependent parent, that person must first qualify as being your dependent.

How you do this depends on some different factors, including whether that person is your parent for VA purposes, how much income that individual makes, and the value of select assets of that person.

The VA has rules to help you with these considerations:

The VA defines a parent as a biological or adoptive mother or father, or a person who served as your parent for at least one year before you started your military service.

What makes a parent a dependent parent can be determined by whether that person’s income and net worth are below a threshold dollar limit or if a parent who has substantial income and assets has correspondingly high expenses.

If a parent’s income is less than a certain monthly income amount, then under VA regulations that person automatically qualifies as a dependent parent.

This threshold is $400 monthly for one parent not living with the other, and $660 if both parents live together or if a parent remarries and is living with the new spouse.

Also, if either parent is under a legal or moral obligation to support another relative, each such person might qualify you to receive another $185 in monthly benefits.

If your parents do not qualify for conclusive dependency, you may still be able to qualify them as dependents.

When you apply for dependent benefits for them, the VA will assess their income from all sources and the current value of some of their assets like bank accounts, bonds, stocks, and annuities.

The VA will then offset against the income and assets personal expenses, including some medical costs and household-related budget items like rent, taxes, groceries, utility bills, and home repairs and maintenance.

If this calculation satisfies the VA that your parents are financially dependent on you, then they qualify for the dependent parent benefit.

Unlike with VA Dependency and Indemnity Compensation benefits, which are paid to dependents of deceased veterans, no published income limits apply to disabled parent benefit eligibility.

Parents with high income but who also have high medical expenses, for example, may still qualify as dependents if they still must rely on you for support.

You apply for the dependent parent benefit by using VA Form 21-509, “Statement of Dependency of Parents.” Note that, unlike applications for dependent spouses and children, which you can submit online, the application to add a dependent parent must be submitted by mail.

Our VA Disability Calculator lets you include your spouse, dependent children, and dependent children into your combined VA rating.

Check the appropriate boxes and fill in the proper numbers in the fields, and the calculator will automatically include them in your monthly disability compensation estimate.

Sometimes your disability, although not 100 percent, can still keep you from being able to work.

If this happens, you might still qualify for a 100 percent disability rating if you meet both requirements below:

If you meet these requirements, then the VA will increase your disability compensation to the same rate as a veteran who is rated at 100 percent service-connected disability.

You can file for total disability for individual unemployability (TDIU) at the same time you file your service-connected disability benefit application. You will need to complete two additional forms with your application package:

Some disabilities are so severe that they can interfere with your ability to perform basic life activities like dressing, bathing, or even feeding yourself. They can confine you to bed for long periods of time, or even require you to live in a nursing home.

In these situations, you might need the help of another person to care for yourself.

Special Monthly Compensation (SMC) benefits can be available to help offset your costs connected with this need.

The main requirement to qualify for SMC benefits is that you must while serving have lost, or lost the use of, a body part or organ. Qualifying examples include:

You can qualify for SMC benefits on a number of levels, depending on the severity of the underlying disabilities.

Level One: “SMC-K” Benefits. Some SMC benefits come in addition to your regular service-connected disability benefits, up to a certain combined dollar amount.

The term “SMC-K” is the VA code for these added SMC benefits.

These combined benefits are subject to a dollar amount maximum: they cannot add up to more than the benefit amount you would receive if your disability resulted from any of the following “SMC-L” disabilities:

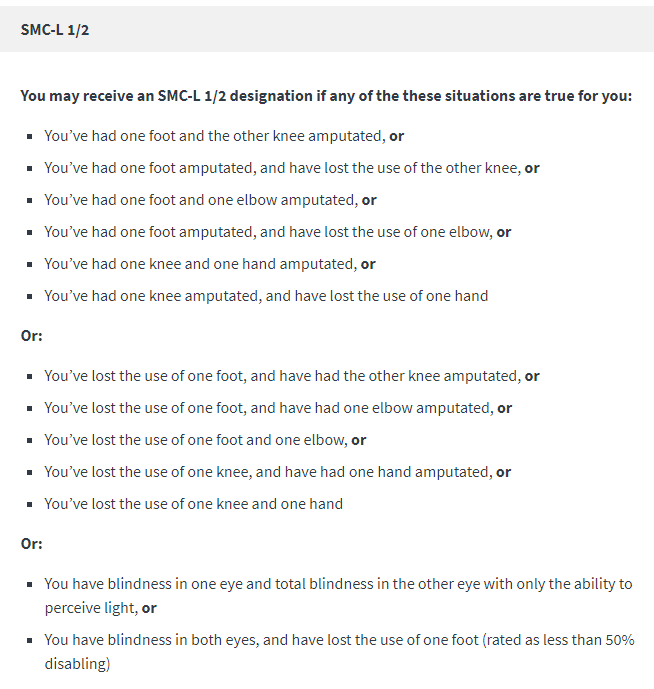

For SMC categories SMC-L through SMC-N, the VA uses an additional “1/2” category to fine tune disabilities that are less than full disabilities. For example, in the following VA description of SMC-L 1/2, you can see the following variations from the SMC-L disabilities above:

For the sake of simplicity, we will not go over all the “1/2″ variables of each SMC category, but you should be aware of them if you are thinking about qualifying for SMC disability benefits instead of basic disability benefits.

Level Two: “SMC-M” Disabilities. As the severity of your SMC disabilities increases, so do your possible SMC benefits. SMC-M is the VA term to describe the following disabilities that qualify for a higher monthly benefit in lieu of the basic disability benefit:

Level Three: “SMC-N” Disabilities.

Level Four: “SMC-O” Disabilities.

Your maximum SMC benefit amount, no matter how calculated, cannot be more than what you would receive if you qualify for Level Four above.

If you have reached the maximum amount of SMC disability benefits allowable, and you are bedridden, housebound, or need the help of another person to perform basic life activities, then you may be able to receive additional SMC aid and attendance benefits.

Aid and attendance support can come from a licensed healthcare professional, or someone helping you under the supervision of a licensed healthcare professional.

The person being supervised does not need to be a healthcare professional; a spouse or other relative living with you or even a friend of yours can provide you with aid and attendance services.

If you need aid and assistance services to stay at home instead of at a nursing home or other assisted living care facility, then you can qualify for a greater amount of SMC aid and assistance benefits.

You can also qualify for this greater benefit amount if you have suffered a traumatic brain injury that requires someone to support you with aid and assistance to avoid having to leave it for a care facility.

If your spouse is totally blind or has 5/200 or lower visual acuity in both eyes, or is a patient at a nursing home because of a mental or physical incapacity, then based on that person’s marital status with you he or she may also qualify for aid and attendance benefits.

Our VA Disability Calculator lets you factor in spousal aid and attendance in Step 2.

If you have one service-connected condition the VA rates at 100 percent and have another single or separately combined disability rating of at least 60 percent, then you can qualify for the “permanently housebound” SMC disability benefit. You can also qualify as being permanently housebound if, because of your disabilities, you are substantially confined to your home for the rest of your life.

Note that the permanently housebound benefit is an alternative to the aid and attendance benefit above. You cannot qualify for both at the same time.

You can apply for SMC benefits using VA Form 21-526EZ to initiate the benefit claim and VA Form 21-2680 as an additional form for the SMC claim.

You will need to include supporting evidence with your application to show how your injury, illness, or other disability affects your ability to perform the activities of daily living listed above.

Also, if you are already in a nursing home or other assisted living facility, then you will need to include VA Form 21-0779 with your benefit application.

Now that we have reviewed the basics of how the VA calculates your combined VA disability ratings and decides whether you qualify for any additional benefits for your dependents and special conditions, we can better understand how the VA calculates the amount of your disability benefits.

The VA provides helpful tables to estimate your basic disability benefit payments. We have made them easy for you to use by building them into our VA Disability Calculator, but to help you understand where the calculations come from we will illustrate parts of these tables below to explain how they work.

Start by finding your specific dependent status in the left-side column. Next, trace right until you match your combined disability rating in the top row of the table.

For example, the table below is for disabled veterans with no dependents, or if they have dependents but they have no children:

| Dependent Status | 30% | 40% | 50% | 60% |

|---|---|---|---|---|

| Veteran alone | 524.31 | 755.28 | 1,075.16 | 1,361.88 |

| With spouse | 586.31 | 838.28 | 1,179.16 | 1,486.88 |

| With spouse and 1 parent | 636.31 | 904.28 | 1,262.16 | 1,586.65 |

| With spouse and 2 parents | 686.31 | 970.28 | 1,345.16 | 1,686.65 |

| With 1 parent | 574.31 | 821.86 | 1,158.16 | 1,461.65 |

| With 2 parents | 624.31 | 887.86 | 1,241.16 | 1,561.65 |

The table below is one you would use if you have one dependent child:

| Dependent Status | 30% | 40% | 50% | 60% |

|---|---|---|---|---|

| Veteran with 1 child only | 565.31 | 810.28 | 1,144.16 | 1,444.88 |

| With 1 child and spouse | 632.31 | 899.28 | 1,255.16 | 1,577.88 |

| With 1 child, spouse, and 1 parent | 682.31 | 965.28 | 1,338.16 | 1,677.88 |

| With 1 child, spouse, and 2 parents | 732.31 | 1031.28 | 1,421.16 | 1,777.88 |

| With 1 child and 1 parent | 615.31 | 876.28 | 1,227.16 | 1,544.88 |

| With 1 child and 2 parents | 665.31 | 942.28 | 1,310.16 | 1,644.88 |

If you have additional children, you use another table to calculate their benefit amounts:

| Dependent status | 30% disability rating (in U.S. $) | 40% disability rating (in U.S. $) | 50% disability rating (in U.S. $) | 60% disability rating (in U.S. $) |

| Each additional child under age 18 | 31.00 | 41.00 | 51.00 | 62.00 |

| Each additional child over age 18 in a qualifying school program | 100.00 | 133.00 | 167.00 | 200.00 |

More tables exist for combined VA disability ratings of 70 to 100 percent. They use the same categories as the tables for 30 to 60 percent, so we will not show them here.

If you or your spouse qualify for SMC disability compensation, the VA uses separate tables to set your additional disability benefit amount. Here are some examples:

In the table below, “SMC-K” is the term the VA uses to refer to SMC benefits you can receive in addition to your basic disability benefits.

For each qualifying SMC-related disability, your disability benefit amount increases by the monthly payment amount shown, up to three times.

| SMC letter designation | Monthly payment (in U.S. $) | How this payment variation works |

|---|---|---|

| SMC-K | 132.74 | If you qualify for SMC-K, we add this rate to your basic disability compensation rate for any disability rating from 0% to 100%. We also add this rate to all SMC basic rates except SMC-O, SMC-Q, and SMC-R. You may receive 1 to 3 SMC-K awards in addition to basic and SMC rates. |

When you go into SMC-L and higher disability benefit amounts, it becomes apparent that they can add up to much more than basic disability benefits.

Here are VA tables for SMC-L through SMC-N benefits, including additional amounts for spouses who receive aid and attendance:

Like with basic disability benefits, the benefit amount you receive increases if you have dependents:

Because our purpose here is to familiarize you with how the VA calculates your SMC disability benefits and not to duplicate the VA website, we will not cover all the possible variations.

What you should take away, though, is that calculating your service-connected disability amounts can be time-consuming, and—especially for SMC benefits—potentially confusing. That is why we have prepared a simplified VA rating calculator for you to use.

Our VA Disability Calculator assumes that you already know what your individual and combined VA disability ratings are, and the kind of disabilities you have. All you have to do is to enter your disability ratings, let us know how many dependents you have, and tell us if you have a spouse receiving aid and attendance.

We do all the “VA math” for you to calculate your 2024 VA disability compensation estimate.

Let’s show an example of how our disability calculator works.

Remember the Bilateral Factor example we used earlier, with the 50 percent left elbow disability rating and the 20 percent right wrist disability rating that eventually became a combined disability rating of 100 percent?

The VA Disability Calculator also lets you fine-tune your monthly benefit eligibility estimate to include your spouse, dependent children, and dependent parents.

Particularly if you have any disabilities that qualify for SMC disability benefits, your actual benefit eligibility may vary considerably from the 2024 VA calculator estimate.

VA disability and benefits laws and regulations are many, and they can be challenging to understand if you are not already experienced with them. If you need help with any of these questions—

“What is the difference between VA pension benefits and VA disability benefits?”

“Do I have a service-connected disability?”

“Am I eligible for special monthly compensation disability benefits?

“How do I make a disability benefit claim with the VA?”

“How do I know whether I or my spouse qualify for aid and attendance benefits?”

“How does the VA calculate my disability benefit amounts?”

“What do I do if the VA rejects my claim for disability benefits?”

“What should I do if my disability status changes, like a dependent child getting married or my existing disability condition worsens?”

—or if you have any other questions about VA disability claims, benefits, and appeals, at Stone Rose Law we can help you not only answer them but also take action.

As the largest military and veteran’s benefits firm in the state of Arizona, led by seasoned trial attorneys and military veterans, our firm has the knowledge, training, and experience necessary to obtain the veterans benefits you have earned.