Fortunately, if medical debt becomes too much for you to afford, it is possible to discharge medical costs through bankruptcy. This post covers some of the considerations that can help you decide whether bankruptcy protection is the right choice for you if you are having trouble affording medical expenses.

To answer your question as quickly as possible, call Stone Rose Law at (480) 739-2448 to speak with a bankruptcy attorney, or use our contact form to explain your situation.

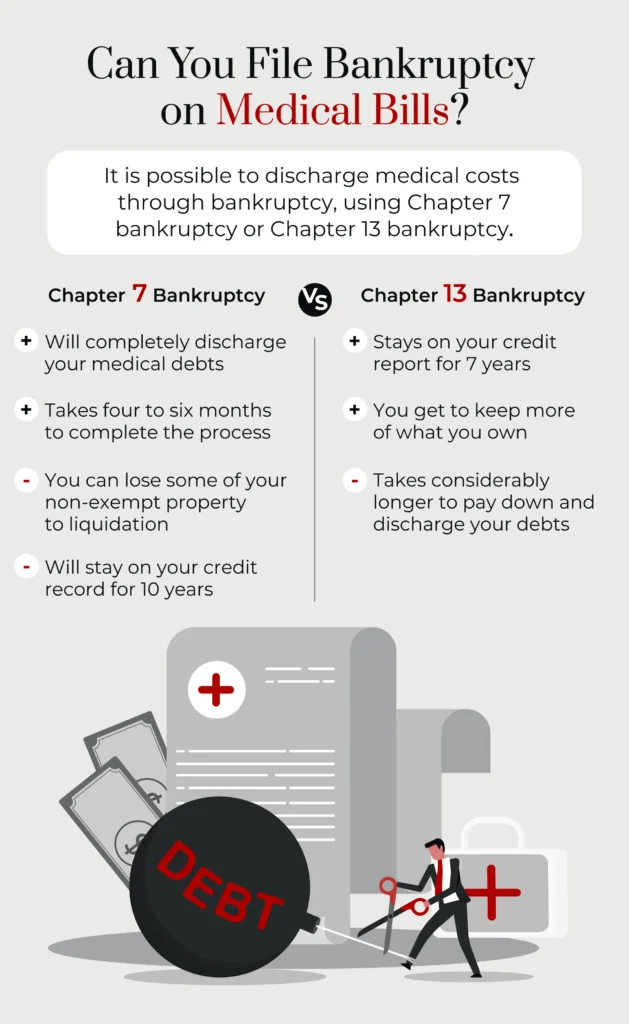

You can discharge medical debts using Chapter 7 or Chapter 13 bankruptcy. Each has unique aspects.

Chapter 7 bankruptcy will completely discharge many unsecured debts, including medical. The purpose of Chapter 7 is to give you a fresh start once your case is closed.

Chapter 7 is also known as liquidation bankruptcy because some of what you own is subject to sale (liquidation) to partially pay your creditors.

The first consideration for Chapter 7 bankruptcy is whether you qualify for it. This depends on whether you can pass the “means test.” The main consideration of the means test is whether you make too much income to use Chapter 7. If this is the case, you can consider Chapter 13 bankruptcy below.

If you qualify for Chapter 7, then there is no limit on how much medical debt you can discharge. Another advantage of Chapter 7 bankruptcy is that it ordinarily only takes four to six months to complete the process.

The main potential downside of using Chapter 7 is that you can lose some of your non-exempt property to liquidation. Your bankruptcy attorney can help you to identify what property you can keep, but you may lose some of your assets.

The other drawback of Chapter 7 is that it will stay on your credit record for 10 years.

Chapter 13 bankruptcy proceedings differ from Chapter 7 in the following key ways:

Under Chapter 13, you will have to pay back some of your medical bills. Your repayment plan is based on your ability to pay. The bankruptcy court will discharge the remaining debt when you successfully complete the repayment period.

One advantage of Chapter 13 is that it does not stay on your credit report for as long as Chapter 7 does. The period is seven years, compared to 10 years.

Another key advantage is that you can keep more of what you own, including your home if it is being threatened with foreclosure.

Unlike Chapter 7, which usually takes only a few months to complete, Chapter 13 takes considerably longer to pay down and discharge your debts. You will need a stable income throughout the repayment plan period and consistently make your payments.

In some situations, if you have too much debt, Chapter 13 bankruptcy may not be available.

For many people, the inability to pay medical bills is often not the only reason for considering bankruptcy but rather the “final straw” when they are struggling financially. Indeed, bankruptcy is generally not an option to eliminate a single debt if you are current with your other payments.

Also, bankruptcy will not discharge all debts. For example, even if you can discharge overwhelming medical debt, if you owe taxes, child support, spousal support, or student loans, these may remain with you after the closure of your bankruptcy case.

Bankruptcy is an option to be carefully considered in advance. It can give you a fresh start from crushing debt but is not consequence-free. A bankruptcy will appear on your credit report for seven to 10 years. It can mean years spent rebuilding your credit, paying higher interest when financing purchases, and making it harder to find a place to live.

If your only past-due creditor is a health care provider, you may have other debt-relief options to consider before bankruptcy. An experienced bankruptcy attorney can help identify your non-bankruptcy choices, like a negotiated payment plan if you have medical debt but no other significant past-due accounts.

For many Arizona residents, a Chapter 7 or Chapter 13 bankruptcy filing can be the answer when it is impossible to pay medical debt. In addition to helping eliminate medical debt, bankruptcy relief can free you from unsecured debt other than for medical care, like past-due utility bills, personal loans, and other unpaid bills.

An experienced bankruptcy attorney, like one you can find at Stone Rose Law, can help you understand how medical bankruptcy might be for you if you have overwhelming healthcare expenses. We can explain how the personal bankruptcy process works and how it can give you immediate relief from medical creditors, collection agencies, and wage garnishments.

Call us at (480) 739-2448 to speak with an Arizona bankruptcy law specialist, or use our contact form to schedule a free consultation.