Filing for bankruptcy in Arizona is relatively inexpensive. It currently costs $338 to file for Chapter 7 bankruptcy and $313 to file for Chapter 13.

However, filing for bankruptcy is difficult and time-consuming, so having a bankruptcy attorney is extremely important. Plus, paying attorney fees is only a fraction of the cost of paying off all of your debt.

Call (480) 739-2448 to have the experienced bankruptcy attorneys at Stone Rose Law help you get your financial life back in shape.

In this post, we discuss some specific things to remember when considering the costs involved in filing for bankruptcy.

The costs associated with bankruptcy can be divided into two main categories: court filing/administrative fees and attorney fees.

In Arizona, you can find filing fees for the U.S. Bankruptcy Court on its website. The filing fees page lists many kinds of fees, depending on various legal filings and other actions. Here are some of the more relevant ones as of December 1, 2023:

As you can see, these one-time bankruptcy court filing fees are not unreasonably expensive, especially when compared to many car loan payments, payday loan repayments, medical bill payments, or even credit card payments.

In some circumstances, if paying bankruptcy court filing fees for Chapter 7 bankruptcy is more than you can afford, paying the fee in installments may be possible instead of a one-time up-front filing.

If installments are too expensive, you may be able to apply for a fee waiver. On the fee waiver form, you will need to provide information on your property, your monthly income, your expenses, secured and unsecured debts you owe, the creditors for each, the property you claim as exempt from bankruptcy, and any co-debtors.

The bankruptcy court may waive the filing fee if the court concludes that your income is less than 150% of the official income poverty line that applies to your household, and you cannot pay the fee in installments.

Once you file for bankruptcy, you will have 180 days from the petition filing date to take a debtor education course (also known as a credit counseling course) from an approved provider. These courses, provided by credit counseling agencies, are inexpensive. You may be able to find one that costs less than $10.

You will need to file your course completion certificate with the bankruptcy court; this may require you to pay a filing fee.

Also, before your bankruptcy discharge becomes effective, you will need to complete an approved financial management course (also known as pre-discharge debtor education) and file your completion certificate with the court. The cost of financial management courses is about the same as that of debtor education courses, but in Chapter 13 bankruptcy, the fee for this course may be available for free through the bankruptcy trustee office.

In an indirect sense, you may still be responsible for some costs once the bankruptcy court discharges your Chapter 7 or Chapter 13 case.

In a Chapter 7 bankruptcy, for example, although it will eliminate most of your unsecured and secured debt, you may still choose to keep making payments to some creditors. This can be done either voluntarily to keep a secured creditor from repossessing an item of personal property or through a reaffirmation agreement.

In a Chapter 13 bankruptcy, your debt repayment plan will require you to make monthly payments during the duration of the plan period.

How much you pay for lawyer fees in bankruptcy depends on how much legal assistance you believe you need.

For example, you are not required to have attorney representation in bankruptcy. You can represent yourself.

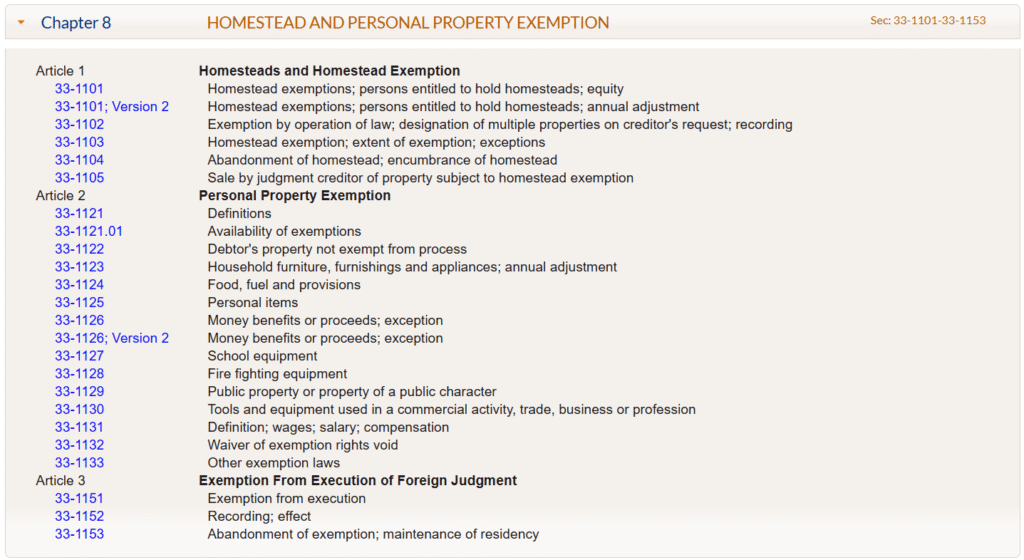

But should you do this? The U.S. Bankruptcy Code and the Federal Rules of Bankruptcy Procedure can be complex, and the Bankruptcy Court for the District of Arizona has its own local rules.In addition to federal laws and rules, Arizona has some of its own laws that apply to bankruptcy, like statutes that apply to homestead and personal property exemptions.

Most people who are not trained as bankruptcy lawyers hesitate to represent themselves in federal bankruptcy court, and for good reason. If you make a mistake because of a lack of knowledge or experience, it could cost you in processing delays, additional costs, and in the worst case, could even lead to dismissal of your petition.

Having an experienced bankruptcy attorney—like one from Stone Rose Law—represent you can make all the difference compared to relying on a non-specialist attorney.

To learn more about how our law firm can affordably represent you in an Arizona bankruptcy matter, here are some resources for you:

To arrange for a free consultation with an experienced bankruptcy lawyer, call us at (480) 739-2448 or use our contact form.