When you file for Chapter 7 bankruptcy, your assets become part of what is known as the bankruptcy estate. If you have a tax refund coming, this is considered an asset for bankruptcy estate purposes, which means you may lose your refund.

However, multiple factors can come into play that, in some situation,s will let you hold on to it.

In this article, we cover the considerations that apply to tax refunds in Chapter 7 bankruptcy cases and ways you can increase your chances of keeping your tax refund.

If you have questions about Chapter 7 bankruptcy, please call Stone Rose Law at (480) 739-2448 to receive a free consultation with a bankruptcy attorney who will be more than willing to help you.

In your petition for Chapter 7 bankruptcy, you must declare all your assets and debts. You can expect the court-appointed trustee in bankruptcy to ask you during the meeting with your creditors whether you have received or are expecting to receive a tax refund.

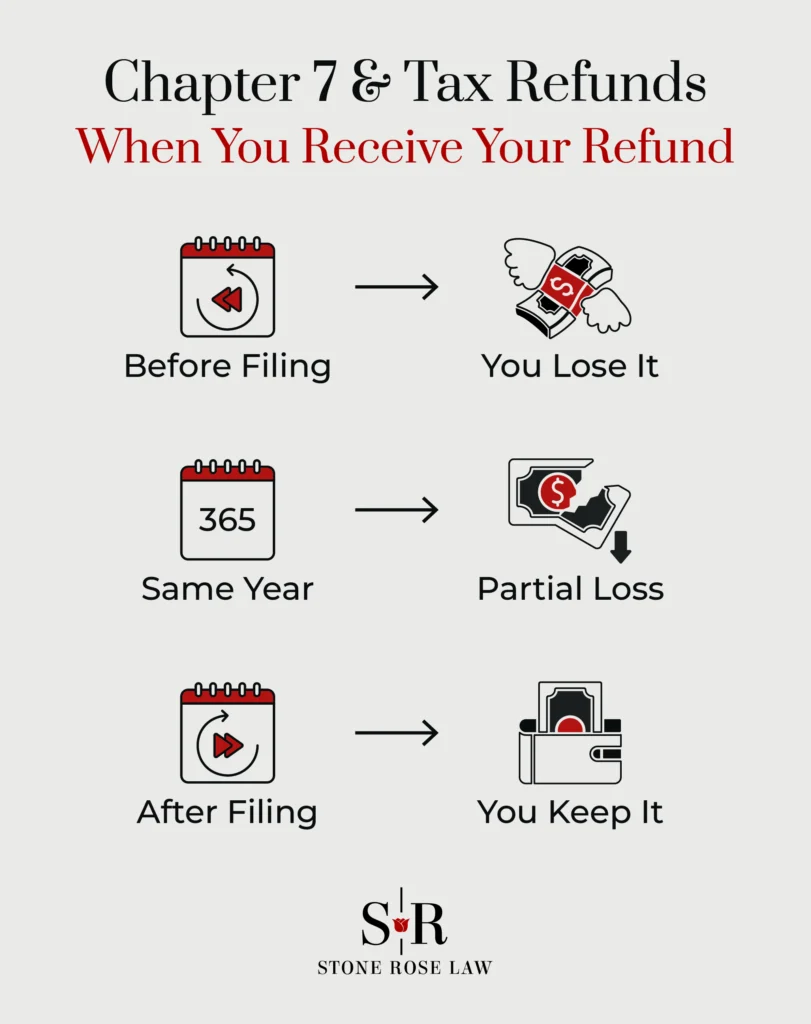

The significance of this question is based on when you received, or will receive, your refund. This is because under bankruptcy law, the timing of your tax return counts when it comes to deciding how much of your refund will become part of the bankruptcy estate.

The table below shows how the timing of your tax refund affects this consideration.

| Status of your Tax Refund at the time of Filing | Status of Your Tax Refund |

| You have not received your refund for a tax year before your bankruptcy filing date.Example: You are filing in February 2026, and you have not received a 2025 tax refund. | All of your tax refund will become part of the bankruptcy estate. |

| You have not filed the taxes for the current year because it is not due yet.Example: You are filing in June 2025, and you are not required to file your 2025 taxes until next year. | The portion of your tax refund based on income you earned before you file will be part of the bankruptcy estate. This may also be calculated based on how far in the year you are filing. For example, if you file in June 2025, this is 50% through the year. The bankruptcy estate has a 50% interest in your 2025 tax refund you expect to receive in 2026. |

| You receive your refund before you file for bankruptcy. | You can keep your full tax refund.Note: A portion of the year you are filing in and not due yet, and may still be part of the bankruptcy estate. |

This timing consideration is not where the inquiry ends.

The next consideration is whether you have ways to prevent your refund from being consumed by the bankruptcy estate.

In many cases, you do have options, but you need to exercise them carefully.

To prevent your tax refund from being included in the bankruptcy estate, you must:

One way to prevent your tax refund from being distributed to your creditors is to allocate it for your own purposes first. There are different ways you can accomplish this.

If you anticipate the need to declare bankruptcy far enough in advance, you can work with your employer to decrease your tax withholding to minimize your refund. This method requires planning in advance and carefully balancing how your tax obligations are withheld from your paycheck.

If you have already received your tax refund but have not filed for bankruptcy yet, you can still protect your refund from becoming part of the bankruptcy estate by spending it in appropriate ways, such as on necessities.

Necessities are budget items that are related to your living expenses.

Examples of necessities you can spend your refund on include:

Be sure to keep track of what necessities you spend your refund on and how much.

Get and save receipts for these expenses.

Also, avoid paying costs in advance, like multiple mortgage or rent payments, because the bankruptcy trustee may consider these to be preferential payments (see below).

If the trustee or your creditors believe that you have spent your refund just to avoid having to pay your creditors, this can get you into trouble with the bankruptcy court.

Some specific examples of spending to avoid are:

The last two of these items are unfair preferences under bankruptcy law.

If the bankruptcy trustee believes you have engaged in this kind of spending to pay creditors, the trustee may attempt to recover those funds, which can jeopardize your bankruptcy discharge before the bankruptcy court.

Under Chapter 7 bankruptcy, your non-exempt assets are subject to liquidation. However, you have some exemptions available to exclude assets from liquidation by the bankruptcy trustee.

For example, there are specific state and federal exemptions that protect your house, household items like your furniture, clothing, and your car.

Federal exemptions and some state exemptions include a “wildcard exemption” that you can apply to property and assets not subject to specific exemptions, such as tax refunds. Unfortunately, Arizona does not allow the use of the federal wildcard exemption, and is not a state with its own wildcard exemption.

In Arizona, for a personal bankruptcy, you can exempt up to $5,400 of financial assets in a single bank account (ARS 33-1126(9)). This amount changes annually and doubles if you are married. If you receive your tax refund before filing and it is in your bank account, this exemption can be applied.

Arizona also allows for exemption of the refundable child tax credit and earned income credit portion of federal and state tax refund under ARS 33-1126(11).

If you have questions about how to keep your tax refund from becoming part of your Chapter 7 bankruptcy estate or how to file bankruptcy under Chapter 7, an experienced Arizona bankruptcy attorney at Stone Rose Law can help.

Call us at (480) 739-2448 or use our online contact form to connect with one of our bankruptcy lawyers and to set up a free consultation.

A Stone Rose Law bankruptcy attorney can show you legal and practical ways to protect your tax refund from creditors.